When it comes to growing personal savings we have a tendency to look for short cuts or hope to win Lotto. In fact we often do everything except what we should be doing, which is setting up some short, medium and long term savings goals.

A recent poll by the Australian Securities and Investments Commission (ASIC) looked at the variety of techniques being used by people who do manage to save successfully. The five main strategies include: * 78% say knowing how much money is needed * 75% report having a clear savings plan * 73% say they regularly review progress towards their goal * 72% set a specific saving timeframe, and * 43% tell family and friends about their goal.

These results confirm my own experiences. Let me explain by telling you about a babysitter we used to have. She reckoned she couldn’t save money at all. Then one day she decided to travel through Europe for a year and, of course, she needed some money. Suddenly she could save. New clothes or going out every night now seemed less important than achieving her goal. As she gradually got closer to her goal, she was spurred on even further by her success.

It’s the same for all of us. Setting some goals gives us the motivation to save rather than spend, and it turns out that an upcoming holiday is a common motivator reported by almost one in two (47%) keen savers. ASIC’s research revealed other popular savings goals – like saving to buy or renovate a home (48%) or just aiming to grow an emergency fund (33%).

The survey found men and women approach saving quite differently. Women are more likely than men to save for more than one thing at a time, with 39% of woman describing their savings style as ‘slow and steady’. Men on the other hand are more likely to focus on saving as quickly as possible.

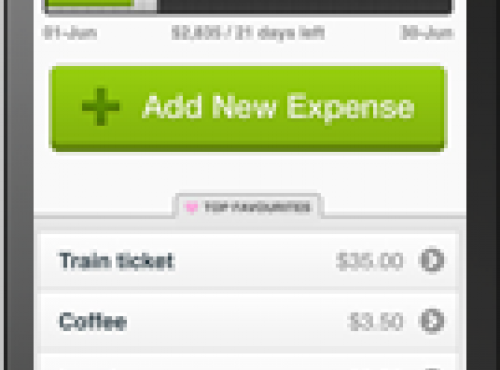

To help make saving a little easier, ASIC has launched a new TrackMyGOALS app. It integrates the techniques that go hand in hand with successful saving, allowing users to create multiple goals and set reminders with the added support of daily savings tips. The app can be downloaded for free from ASIC’s MoneySmart website (www.moneysmart.gov.au)

Bear in mind, successful savings doesn’t mean having to take on a second job or scrimping around and leading a miser’s life. We all make regular savings whether it’s by taking our lunch to work, buying supermarket specials or having a night at home instead of heading out. The problem is that the money you have saved may never become tangible savings unless you deliberately put it away.

That’s why it’s worth getting into the habit of ‘saving your savings’. You’ll find that as time goes by, those small cutbacks you’ve made on various purchases will become cash in the bank. And with time and commitment you should be able to achieve your personal goal.