See what things you might have at home that could deliver you cost savings later on.

For the next time you’re itching to get out, but don’t want to spend a fortune, here’s a list of 10 things to do for about $10 (or less).

Six out of ten Australians own investments outside of the family home and super. That’s good news.

If I could sum up the contents of my junk emails over the last 12 months in a single word it would be: Bitcoin. I can’t tell you how many unsolicited invitations I’ve received to start trading bitcoin – you may have experienced the same thing. This alone is a concern but when heavy hitters like the International Monetary Fund (IMF) start calling out the risks of bitcoin, the warning bells should definitely start ringing.

If, like many others, your life and money feels a bit like a juggling act - paying bills here and there… and “Uh oh, forgot about the council rates, guess that one’s going on the credit card”. You may be thinking that having some extra cash would solve a lot of your problems.

Many women dream of a retirement where they can kick back and relax, do whatever they like and be free from the demands of others – actually focusing on caring for themselves. But this step often means being free from financial worries or concerns and for a large proportion of women, the prospect of a comfortable retirement can seem elusive. Especially when you do the sums.

The end of the financial year will likely bring the usual wave of scams. Here’s what to watch for.

Small business is generally regarded as the backbone of the Australian economy, but that strong back is showing signs of age.

How you’d like to spend your retirement is as unique as you. From the big life changing goals, to the smaller, more personal ones that give your life meaning.

It’s always that time of the year when our thoughts turn to summer holidays, but amid the excitement of choosing a destination, neverforget to arrange travel cover. In the last three years, one in three Australians have headed off internationally without the protection of travel insurance.

I recently came across a news story about a hapless New York couple, who have taken their 30-year old son to court in a last ditch effort to get him to move out of home. My first thought was “only in America”. But here in Australia, high rents and low housing affordability are seeing plenty of parents shelve plans for an empty-nester lifestyle as their 20-, 30- and even 40-something offspring show no signs of leaving the family home.

The line “as rich as Croesus” is littered through literature in works as bizarrely diverse as Alexandre Dumas’ The Three Musketee

The choices we make in life have a big influence on our personal happiness and also on the wellbeing of those we love. Sometimes we anticipate choices with a sense of excitement. And sometimes life throws us curve balls in the form of unexpected events and important decisions.

Every parent wants the best for their children but kids often won’t listen to the wisdom of your experience, especially when it comes to money. Don't give up! Here are some of the common beliefs and misconceptions kids have about managing money—and how you could get them to take your advice.

What exactly is income protection insurance and do I need it?

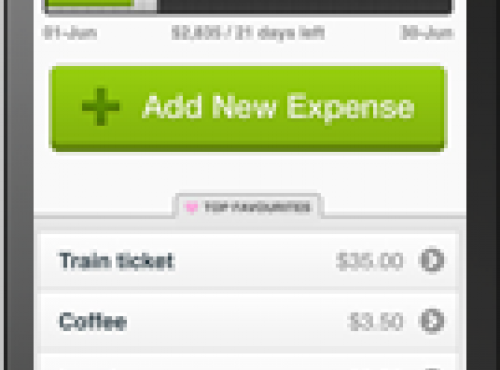

Using goals to achieve your dreams. Many people don’t find budgeting and saving easy, nor is it on top of their priority list. Most of us are programmed to look for short cuts, or believe that with a bit of luck – and rising house prices – ‘we’ll be right’. But in reality, saving for the lifestyle we want does require a degree of discipline and an active interest in looking after your finances. And one of the easiest ways to do this is by setting up some short, medium and long term financial goals.

Northern Territory Concession Scheme and Northern Territory Seniors Recognition Scheme. From 1 July 2018 the Northern Territory Government will introduce the NT Concession Scheme (NTCS) and NT Seniors Recognition Scheme (NTSRS).

A budget can help you work out what you’re spending money on and when.

It's an honour to be named as a #TelstraBizAwards Finalist.

The common thread shared among Walt Disney, Paris Hilton and Britney Spears goes well beyond entertainment. They are all clients of a non-profit company that researches, advocates for and performs cryonics. That is, the preservation of humans in liquid nitrogen after death with hopes of restoring them to full health when new technology is developed in the future.

Intergenerational wealth transfer – or in simpler terms, passing on assets to your family, can be, and often is, a huge issue for all family members concerned. If done well and executed properly, it can make a real difference to the financial position of the recipients. If misjudged or poorly handled, it can cause enormous grief, fights and resentments that are never forgotten nor forgiven.

Bidding for a property at auction can be stressful but you can reduce the stress involved. Before you consider bidding use our tips to make sure you’re prepared and know what to expect.

Joy and surprises. For most couples, the birth of their first child means surprise, anticipation, awe — and some major financial changes.

Because we are always looking for driven people who want to be part of an award winning team!

"Overall, the prevailing global economic backdrop is very investment-friendly.

Here at All Financial Services, we see the direct impact of men's health all the time. We know how tough it can be on a family and their finances when illness strikes, that's why we've decided to participate in Movember.

It's a horrible topic - something we all hope we (or a loved one) never hear and we all hate talking about it ....

With baby Boomers coming off the production line in their thousands each year, the level of financial and emotional abuse is set to rise

The role of executor – is it an honour or a burden?

The revised proposed changes to super have now passed through both houses of parliament and are due to become part of Australian superann

Donald Trump elected President of the US. Implications for investors and Australia

We spend in excess of $640 billion dollars each year. $8 billion is spent on beauty, $9.5 billion on gadgets and $12 billion on meat each year.*

A long life is something to celebrate, and figures from the OECD show Australians enjoy one of the highest life expectancies in the world. Even better, our life expectancy is rising and is expected to increase well into our 90s over the next four decades. But living longer also raises questions about how we will fund a retirement that could span one-quarter of our life.

I wanted to share with you a small part of my journey and the lessons learned over the last few months.

The government has announced changes to three key 2016 Federal Budget proposals—the most significant being that it would not go forward with its proposal to introduce a $500,000 lifetime cap on non-concessional (after-tax) super contributions.

Dr Shane Oliver, Head of Investment Strategy, Chief Economist AMP Capital, discusses what happens next?

"You've seen the TV advertising about comparing your Super accounts, you know the adds .. 'Compare the Pair'

Federal Treasurer Scott Morrison put forward a number of proposed changes, mainly around contributions to superannuation and taxation, in

This month saw the launch of a national consumer advertising campaign by the Financial Planning Association of Australia (FPA), to contin

Dr Shane Oliver, Head of Investment Strategy and Chief Economist for AMP Capital puts a positive spin on Australia's financial position and where we are headed

Most people know that I am passionate about paying off debts of all descriptions. Obviously budget control is part of that.

As our population ages, there will be a significant rise in the incidence of Cognitive Decline and Dementia, illnesses that pose a signif

From 1 January 2016, the income test deductible amount for most defined benefit income streams has been capped at 10%.

Dr Shane Oliver, Chief Economist and Head of Investment Strategy at AMP Capital offers his insights into current market conditions.

Australians love making New Year resolutions. The only problem is that we’re not very good at sticking with them.

The weather is warming up and the festivities have already started. Each year we reflect on our year and celebrate our successes. Read our Christmas newsletter.

With the silly season fast approaching, it’s time to start planning how you pay for Christmas.

We are a professional team of 16 in the Darwin CBD looking for a Front of House Professional to fill a 4 week temporary assignment.

All the headlines on the overseas grown Berry products causing illness for Australians got me thinking.

The recent decision by the Reserve Bank to cut the official cash rate will put money back in the pockets of home loan borrowers through l

What follows after a long and successful career can feel like a big void to fill, leaving men socially adrift.

In my household my partner is always trying to work out ways to save money or make more.

Australians again top the well-off table.

With about a month to go before the end of the financial year, now is the time to look at ways to save on tax.

All Financial Services are pleased to welcome David Coutts, a financial adviser who brings with him 14 years experience to our friendly t

These days many of our actions and attitudes are shaped by environmental concerns.

I’ve always thought life insurance is something of a misnomer – it should really be called ‘death insurance’ because death is what you ar

For many Australians the idea of running their own business is very appealing, and buying into a franchise is one option that can be a lot easier than starting a business from scratch. However there are no guarantees of success and there lots of pitfalls to avoid.

When it comes to growing personal savings we have a tendency to look for short cuts or hope to win Lotto.

A recent US study conducted by Professor Michael Finke, Director of Personal Financial Planning at the Texas Tech University, charts the decline in our ability to maintain our financial literacy as we age.

Do you know where all your super is?

This month's market watch discusses the following

If you, or your loved ones finances could do with some fine-tuning, it’s worth taking part in MoneySmart Week.

When it comes to investing, everyone wants to beat the market.

The internet has transformed our shopping habits.

Running your own business can offer flexibility plus financial rewards, and if your venture proves successful it can also be a healthy long term investment.

The lead-up to the Federal Budget was dominated by talk of cutbacks, with the National Commission of Audit helping to build

You CAN retire before age 70, despite what some reports are suggesting.

With interest rates at record lows, the returns on savings accounts and term deposits aren’t all that exciting. But high quality shares can pay compelling dividends – and there is a way to get more bang for your buck.

Follow the link to listen to Paul Clitheroe "Talking Money"

Learn on the job, Full time position, Professional team of 12, Office located in Darwin City

All Financial Services is looking for inspiring individuals to join our professional team of 12.

The global economy is expected to grow in 2014, and this may encourage some investors to look beyond Australia and consider investing in overseas share markets.

If you have a self-managed super fund (SMSF), you don’t just need to watch out for the strict laws and regulations that govern SMSFs.

It’s round about now that those post-festive season credit card statements start to arrive in the mail.

This year some new initiatives will come on board that are worth knowing about. They could change the way you manage your money.

AMP have created the first app in Australia where you can view your banking, super, insurance and investments, all in one place.

Keeping kids entertained during the holidays can put a strain on family budgets but with the start of a new school year looming, parents

Now that the government's new MySuper legislation is in place, you may have received a letter from your super provider detailing how you are affected by this new legislation.

Money can be a major issue for all of us at some stage of our lives. But it doesn’t have to be.

Load more